Emory University announced on Monday that undergraduate students’ need-based loans will be replaced by institutional grants and scholarships beginning in the 2022-23 academic year. An expansion of the Emory Advantage program, this change will automatically apply to every undergraduate student who is eligible for institutional need-based aid.

Under the expanded plan, Emory estimates that about 3,300 undergraduates’ need-based loans will be replaced by grants, doubling the current number.

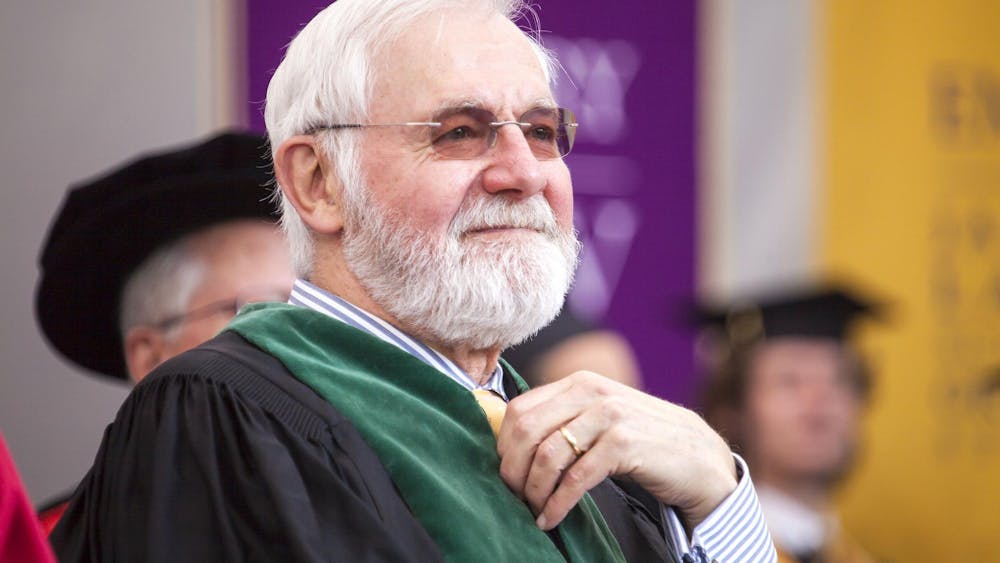

“For Emory to fulfill our mission of serving humanity in all that we do, we are continuing to invest in making an Emory education affordable to talented students of all financial backgrounds,” University President Gregory L. Fenves wrote in the Jan. 31 announcement. “By eliminating need-based loans for undergraduates, our students have the opportunity to earn their Emory degrees with less debt as they embark on their extraordinary journeys after graduation.”

Emory currently awards undergraduates about $143 million annually in need-based aid. Under the expanded program, the University expects to award $151 million.

In a message to the Wheel, Alumnus Maureen Kimani (08C) wrote that she is “extremely proud” of the advancements the University has made in the 18 years since she graduated.

“[I’m] very excited to hear Emory has made it a priority to ensure talented students of all socioeconomic backgrounds are able to attend despite the cost of tuition,” Kimani said. “I think it will help… diversify the college as historically, students from more privileged backgrounds made up the majority of the student body.”

Each year, Emory provides around $353 million in institutional grants and scholarships for undergraduate, graduate and professional students. Students are also awarded $9.7 million in federal grants and scholarship aid, $8 million of which are Pell grants, as well as $6 million in state grants.

Emory Advantage, which was started in 2007, is intended to help families with annual total incomes of $100,000 or less who demonstrate a need for financial aid. The program’s goal is to help students graduate with little or no debt.

Alumna Sarah Lynne DiFranco (99B) wrote to the Wheel that she finds the change “wonderful,” as it will help students afford to attend Emory without being “saddled with debt.”

While in college, DiFranco had work study jobs and waited tables but still graduated with loans totalling more than her annual salary at her first job. She had to attend law school at a cheaper state institution and take out additional loans, all of which she paid off by 2021.

“It will allow those who would otherwise not afford an Emory education get one without starting their careers with significant debt and monthly payments that may be unworkable on a young professional's salary,” DiFranco said. “It will give graduates more flexibility to pursue their passions and meaningful work rather than making sure they have a job that will cover living expenses plus student loans.”

To be considered for the Emory Advantage Program, new students must fill out the College Scholarship Service Profile and Free Application for Federal Student Aid.

Students who are returning for the 2022-23 academic year and are eligible for the extended program will receive more information within the next couple of days in an email from the Office of Financial Aid, according to the announcement.

Iliyah Bruffett (22C) said she is “hopeful” for the opportunity to graduate with little to no debt. She also said the announcement provided her some “relief,” as she is considering taking a gap year before continuing her education to manage the upcoming loans.

“For low-income students like me, need-based loans are necessary for survival, but the payments are daunting, especially knowing that our families may not be able to help us manage these payments while we find our professional paths in life,” Bruffett said.

Bruffett, however, is graduating this year, and the change to financial aid will not occur until the 2022-23 academic year.

“Currently, there are low-income students who have had to take out loans to make it through their time at Emory, so I think it's important to also advocate for the need-based loans of current Emory students to be forgiven,” Bruffett said.

The move follows a trend of a growing number of colleges removing need-based loans in response to economic uncertainty during the COVID-19 pandemic. Smith College removed loans from need-based packages in Oct. 2021. Colgate University removed loans in June 2021, and Ohio State launched a program in Nov. 2021 to remove loans from financial aid packages within the next decade.

Princeton was the first university in the nation to remove need-based loans, pioneering its financial aid initiative in 2001. Several other prestigious universities eliminated loans in the following years, including Amherst, Harvard and Yale.

In the announcement to the University, Provost and Executive Vice President for Academic Affairs Ravi V. Bellamkonda said expanding the program will help make Emory more affordable for students from low and middle-income families.

“I am proud of this investment, as it is consistent with our desire to have our students flourish academically and personally here at Emory and beyond,” Bellamkonda stated. “This is just one way Emory is striving for the special Emory experience to be accessible to all students, independent of their socio-economic status.”

Madi Olivier (she/her) (25C) is from Highland Village, Texas, and is majoring in psychology and minoring in rhetoric, writing and information design. Outside of the Wheel, she is involved in psychology research, the Emory Brain Exercise Initiative and the Trevor Project. In her free time, you can find her trying not to fall while bouldering and obsessively listening to Hozier with her cat.