Bill Gates, the world’s wealthiest college dropout, may be the only excuse to not pursue a college education. But even though he quit school to found Microsoft and then became one of the richest men in American history, he still professes the importance and value of further education. In fact, he told CNN that “getting a degree is a much surer path to success” than luck.

And he’s right; a college degree offers a brighter future than a high school diploma. Yet, after factoring in an average student debt of over $35,000 to an entry-level salary, one can’t help but wonder if college is worth it.

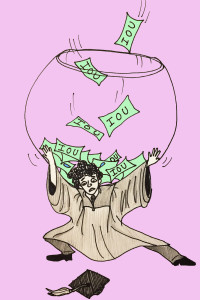

A large amount of students at every university rely on student loans to pay for their education. But these same students have to consider the downside of the loan, which is potentially spending a huge amount of their adult lives paying it back with interest. The repayment process is pretty straightforward; students pay back the amount they borrowed plus a federal loan interest rate that Congress determines.

The government is happy to lend to students, but after graduation, that money becomes debt. And debt is a tricky thing in today’s financial environment because, unless college graduates are Jordan Belfort-ing their way through life and making millions very quickly, they will probably need to borrow money to finance a home and a car.

So walking out of college and just entering the world with a massive amount of debt can impede students’ ability to build the proverbial “American Dream.” In fact, the new policy of the Federal Housing Administration (FHA) makes it even more difficult for people who have taken out student loans to start their lives. Before the new rules went into effect, the FHA did not heavily rely on a person’s debt-to-income ratio (DTI) to decide whether or not they could take out a mortgage on a house, but as of September, the agency “will require that 2 percent of the outstanding student loan balance be counted in calculating the monthly DTI, according to an explanation FHA sent to Congress.”

The new rule affects people differently depending on the current status of the loan. Basically, if your deferred student debt balance is currently $20,000 then the government gets to tack on an extra $400 per month while they recalculate your new DTI until you completely repay the debt. If the debt is non-deferred then all of that money, the $20,000 plus the $400 per month, will go straight into your household debt. Talk about a massive delay on starting adult life, right?

Then again, college is more than just the numbers. It’s an experience that defines us. College may be extremely expensive, but there’s no price tag on making lifelong friends or learning to live with other people or becoming independent. Living in a community outside of the comfort of our childhood home allows us to grow as independent people who can function and thrive on our own. Aside from earning a degree after four years of late nights in the library and multiple 15-page essays, we as college students are granted the opportunity to learn who we are as we transition from adolescence to adulthood.

Certainly, the prospect of college can seem intimidating for a number of reasons, both personal and academic, especially for the many high school seniors who don’t know yet what they want to do with their life. But what is college if not a period to figure that out?

At the end of the day, the benefit of a college degree lasts a lifetime because what we learn here will stay with us forever. And I’m not just talking about the material we cover in our classes, but also about what we learn outside of class like how to write a professional e-mail, do laundry on the correct cycle or cook chicken all the way through.

Learning to live outside our comfort zones teaches us so many intrinsic skills that let us enjoy life after college — and that is what we as students are walking away with. After four years, we can all say that we have improved as individuals because we have grown and flourished here. It seems cliché, but it’s true. College allows us to reach the moment when we become who we are meant to be all by ourselves.

So, even though tuition is rising faster than income, college is definitely worth it, right?

Jessica Cherner is a College senior from Bethesda, Maryland.